Securities

The Securities Division administers the Securities Act through the regulation and oversight of registrants, securities issuers, and self-regulatory organizations. It reviews offering documents, continuous disclosure documents, and exemption applications to ensure these filings comply with securities laws.

This division reviews applications for registration from dealers and advisers who are in the business of trading or advising in securities. Compliance staff regularly conduct compliance reviews on the operations and practices of registered firms and the disclosure of issuers. Staff participate on national committees respecting the development and drafting of securities laws and policies.

Reports and Publications

Research Findings on the Impacts of CRM2 and POS on Investor Knowledge, Attitudes, and Behaviour

The Canadian Securities Administrators has published reports that examined the investment fund industry and investor behaviour following the implementation of the Client Relationship Model Phase 2 (CRM2) Amendments.

2024 Reports

Report on Investment Fund Performance

Report on Investment Fund Fees

2019 Reports

CSA Summary Report 2016-2019 Investor Research Findings on the Impact of CRM2 and POS

Innovative Research Group Inc. CRM2/POS 3-Year Tracking Study September 2019 Report

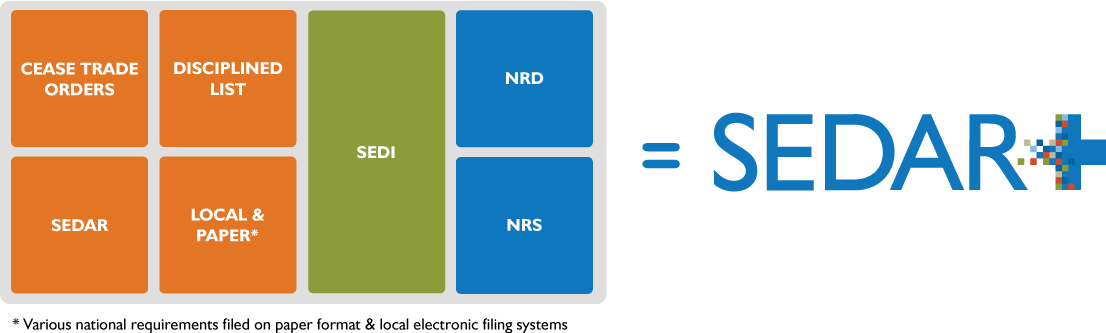

SEDAR+

The CSA is modernizing the electronic filing and data access systems that underpin Canadian securities regulation. SEDAR+ is the new, secure web-based platform that will be used by all market participants to file, disclose and search for information in Canada’s capital markets.