Survey Results: 2023 Sector Survey

The following graphs and information provide results to key questions included in our 2023 Sector Survey.

The Commission’s regulated entities and individuals were invited to complete the survey, which was open from April 26 to May 15, 2023. A total of 221 responses were collected. Among those who completed the survey, the largest representation came from: real estate (30 per cent of respondents); insurance (27 per cent); mortgage brokers/brokerages (16 per cent) and collection agencies (eight per cent).

The survey was conducted and all results analyzed on behalf of the Commission by a third-party consulting firm.

Our 2024 sector survey is now in market. Select the button below to participate.

Clarity on the Commission’s mandate

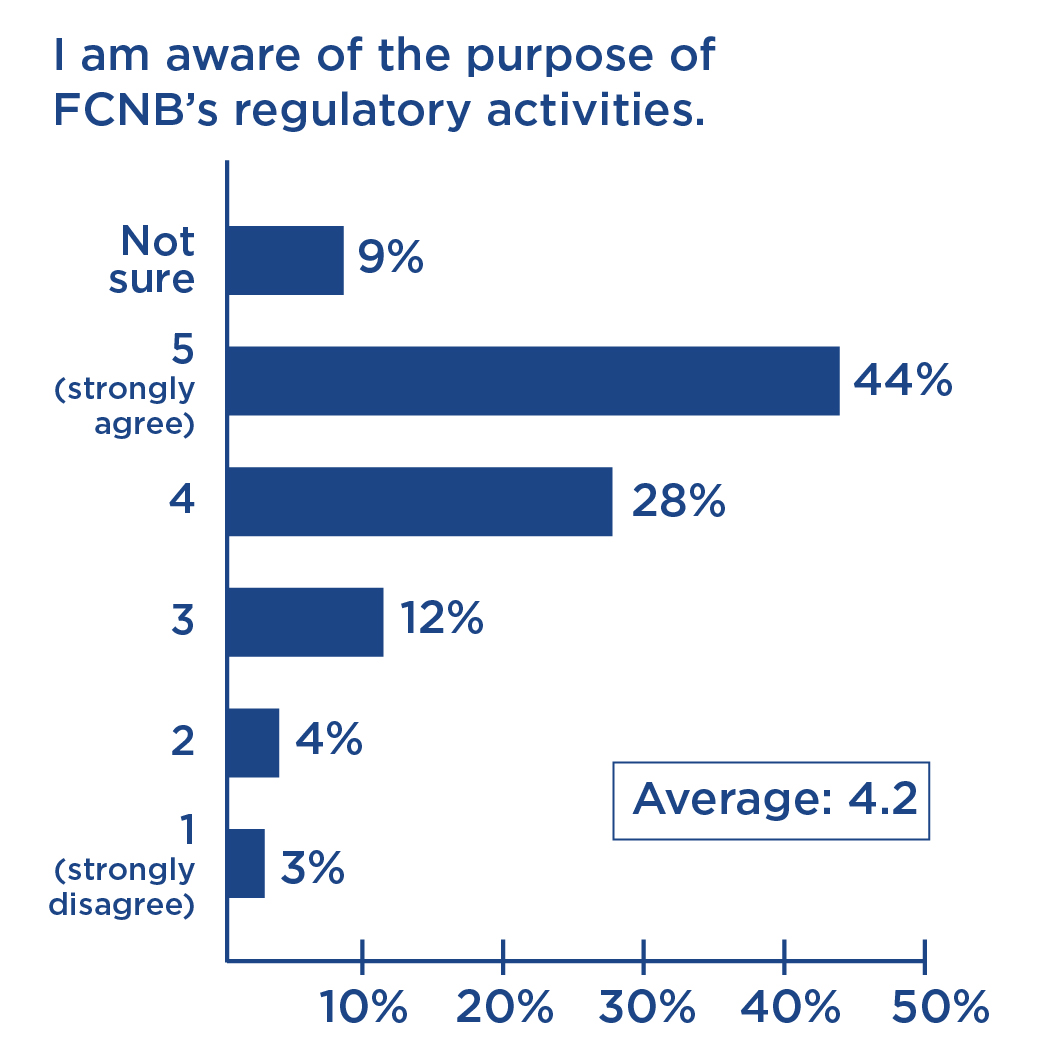

Overall, 72 per cent of survey respondents expressed familiarity (4 or higher out of 5) with the purpose of the Commission’s regulatory activities. The average score was 4.2 out of 5.

Q. Please indicate the extent to which you agree or disagree with the following statements: I am aware of the purpose of FCNB’s regulatory activities.

Graph 1

| Score | Response |

|---|---|

| 1 (Strongly disagree) | 3% |

| 2 | 4% |

| 3 | 12% |

| 4 | 28% |

| 5 (strongly agree) | 44% |

| Not sure | 9% |

When asked to evaluate the Commission across a series of activities relating to its overall mandate, respondents on average gave it an 8.2 out of 10 for prioritizing consumer protection; an 8.1 for promoting high standards of business conduct; a 7.6 for enhancing public confidence in and an understanding of the regulated sectors and a 7.1 for responding to market changes quickly.

Commission’s reputation and trustworthiness

When asked to rate the overall reputation of the Commission, stakeholders provided an average score of 8.1 out of 10. When asked to explain their rating, those with positive ratings tended to praise staff responsiveness and professionalism. While those with lower ratings tended not to provide explanations, comments that were provided tended to relate to the Commission’s low profile.

More than two-thirds of respondents gave the Commission high marks (average 8.2 out of 10) for its trustworthiness as a regulator.

Keeping stakeholders informed

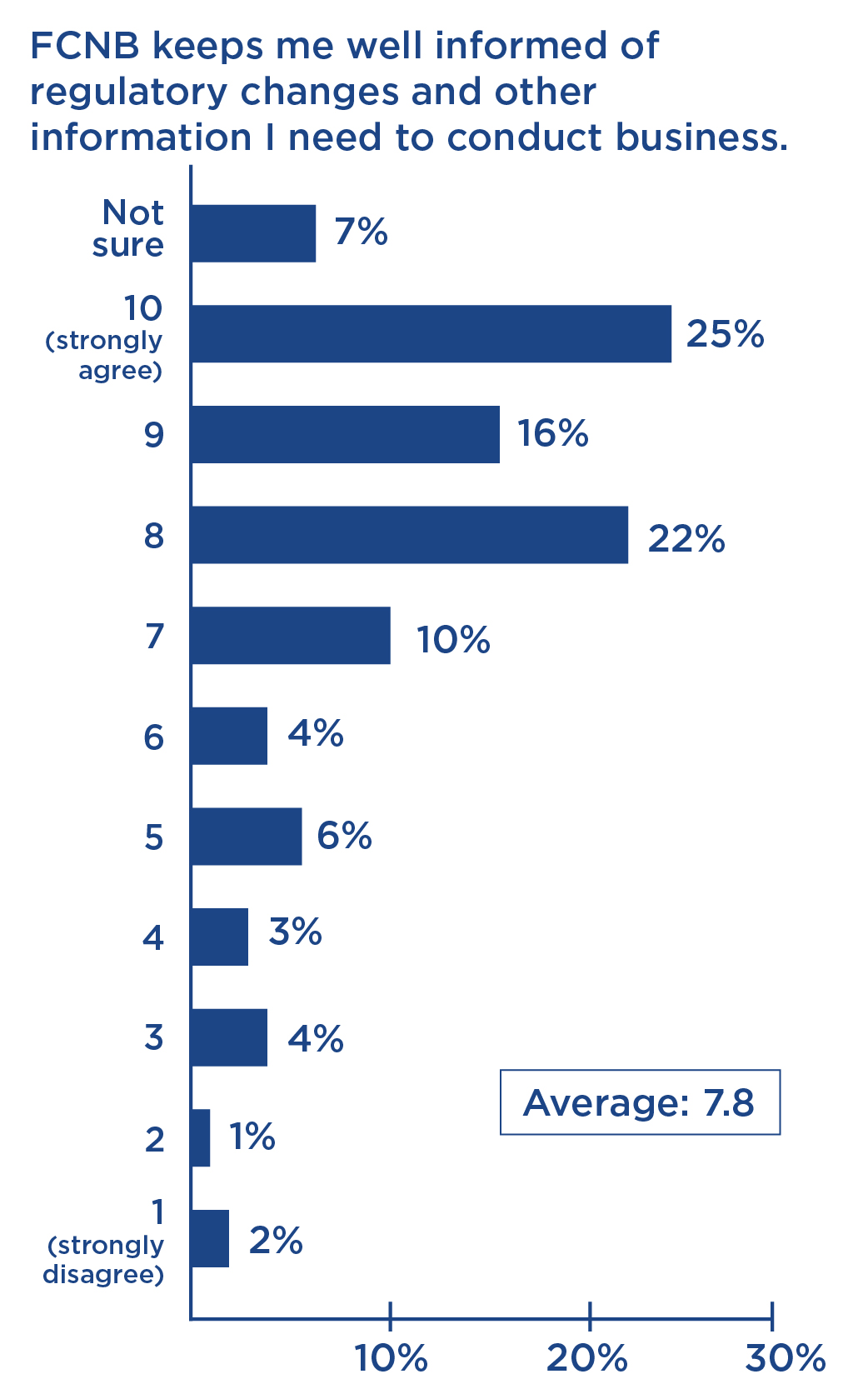

Nearly two-thirds of stakeholders agreed highly (8/10 or higher) that the Commission keeps them well informed of regulatory changes and other information they need to conduct business. The average rating was 7.8.

Q. Please indicate the extent to which you agree or disagree with the following statement: FCNB keeps me well informed of regulatory changes and other information I need to conduct business.

Graph 2

| Score | Response |

|---|---|

| 1 (Strongly disagree) | 2% |

| 2 | 1% |

| 3 | 4% |

| 4 | 3% |

| 5 | 6% |

| 6 | 4% |

| 7 | 10% |

| 8 | 22% |

| 9 | 16% |

| 10 (strongly agree) | 25% |

| Not sure | 7% |

Almost all respondents (92%) who received correspondence from the Commission – either by email or postal mail – were either very or somewhat satisfied with the information they received.

Most respondents (79%) responded that they turn to fcnb.ca when they are looking for information while 60% said they relied on emails from the Commission.

Stakeholder engagement

Most respondents who were contacted by the Commission – or contacted the organization themselves – about a regulatory matter were either very (65%) or somewhat (20%) satisfied with their interaction. Those who provided additional comments were most likely to report a positive experience with staff during this process.

When asked to rate the Commission on how well it listens to market participants, the Commission received an average score of 6.9 out of 10. More than half said the Commission conducts meaningful consultations on guidance and rules that apply to their sector and takes stakeholder feedback seriously. In addition, 49% stated that the Commission provides an appropriate number of opportunities for stakeholders to be consulted.

Licensing

Four in five stakeholders say they were either very (43%) or somewhat (37%) satisfied with the online portal for routine licensing or registration. When asked to provide additional comments, those who did expressed a belief that it could be made more user-friendly.

As a result, the Commission will be examining ways to improve its licensing portals to enhance the user experience.

When asked about the processing time for approving licensing applications or renewals, more than half of the respondents agreed (4 or higher out of 5) that it was reasonable. However, 25 per cent answered they were unsure.

Transparency in decision-making

The Commission received similar scores among respondents for two measures related to transparency in its decision-making. It received an average score of 3.9 out of 5 for transparency in outlining the steps, regulations and procedures used to come to a decision. It received an average score of 3.8 for providing the facts and reasons for its decisions.

As a result, the Commission is examining its approach to publishing regulatory decisions as well as issuing news releases on enforcement and regulatory matters.

More information

For questions related to the 2023 Sector Survey, please contact the Commission at info@fcnb.ca.